The Leaky Bucket: ARR(Truth) or NRR(Tell)?

I've just gone through a thought exercise based on some questions I get asked about Sales and Customer Success that I think you'll find relevant, especially if you're steering your software company towards that sweet spot of viral growth without becoming another SaaS cautionary tale.

We all know these metrics and topics and we all often talk about them in our daily jobs because we all get commissions and bonuses based on them. We all also want our company to survive because we want to keep our job. In my past, these two metrics were the two most talked about metrics and often the two most lied about because the executives didn't want to face the real issues to solve the goals and were only interested in reactive symptoms. I certainly am not going to fix how executives approach their leadership or ethics in this article but I can introduce the math and other aspects of the mterics to younger people working in SaaS companies wanting to learn what their leadership are hiding from them or not hiding and how to get better at what these metrics mean when they are shared in their company meetings.

The crux of the article is all about getting a grip on two key metrics: Net Revenue Retention (NRR) and Annual Recurring Revenue (ARR). These aren't just buzzwords; they're the lifeblood of your SaaS company. There are certainly dozens more metrics that are important but those are more tactical and I can't address all of them so I will focus on the strategic drivers. It may cause some of you to cringe. Sorry about that.

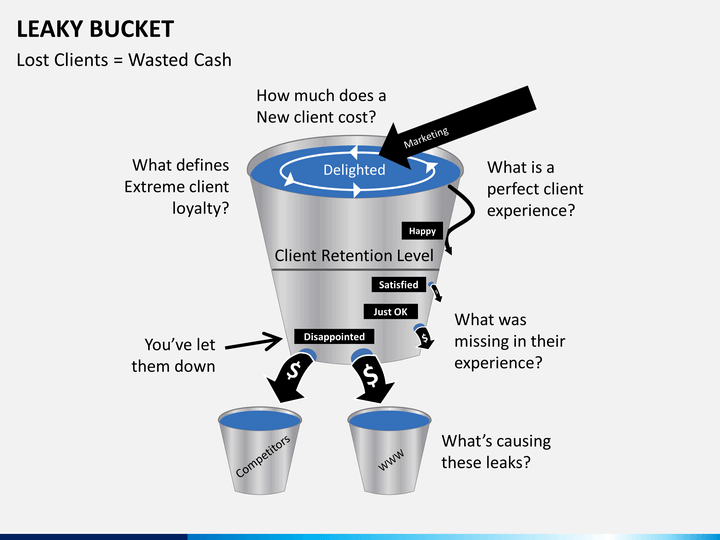

Here's where it gets juicy. Most SaaS companies are walking a tightrope between growth(customers and revenue) and profitability(cost and revenue). You might have a solid ARR, but if your NRR is sliding down, you're just re-filling a leaky bucket vs. cheering the overflowing bucket – I will mention this a few times more below. This is a recipe for becoming a zombie company—kind of alive but not really thriving. You know, surviving on fumes of productivity and the prayers for innovation. It is not the undead existence you want.

Here's another kicker, it's not just Sales and Customer Success that are accountable, of course they are for maintaining the metrics, but innovation is dire in a SaaS company. Your product team and marketing need to be BFFs. If the left hand doesn't know what the right hand is doing, no one's clapping for your product. Sync up! Marketing's insights into customer needs and pain points are pure gold for product development. They can help shape new SKUs that customers will actually want to pay for. Beware! Marketing can get sidetracked if they are not fed new product advancements in a consistent cadence or communicated to when they are to expect them. Marketing needs tangible products not make up new positioning spin that seems like new innovation when it's in fact vapor or lipstick on an old pig. Both need to collaborate to stay ahead of the curve and keep innovating.

To summarize the 4 areas and avoid the SaaS graveyard, you need to align your ARR(Sales) and NRR(Customer Success) with your growth strategies, ensure your product and marketing teams are in lockstep, and leverage customer insights to drive innovation. It's about creating a product that not only sells but sells itself over and over because it's just that good. If you can nail this, you're not just growing; you're growing smart. Management ensures the vision, goals, and objectives.

Once you have the Product and Marketing teams aligned and leads start coming in then executives can start to understand how their Sales and CS departments impact the growth metrics, then customer strategy becomes crucial. They start to set objectives for these teams. They need to do this well in advance to the start of the new FY, often 6mo. before or sooner. Not 3mo into the FY after the start of Q1 and leading into Q2. How many of you have had your management team give you quotas and goals when half the year is over for that same year?

Here are some examples and scenarios. Lets say, strategic growth targets are specifically focusing on achieving over 10-20% annual growth through a blend of customer retention (as measured by, NRR) and acquiring new sales (ARR). These are very common goals. There might even be a stretch goal added.

I gloss over at a high-level, but you will get a good picture of your company or new employer if you ask questions about these numbers and how they are calculated to understand the company's health and how it plans to grow or plug the holes.

A SaaS company's goal is to align all this and flip the script? All SaaS companies want to go viral(RARE) but keep that growth profitable and scalable(also RARE). There are SaaS coaching companies who have studied the best practices of these goals ad nauseam and who can help you if you adopt their best practices. One such company is "Winning by Design", check out the Resources and Blueprints here: (https://winningbydesign.com/resources/blueprints/). They've got a treasure trove of strategies, from Sales as a Science to designing Customer Success frameworks that can make sure your customers stick like glue.

Lets review the main concepts.

Key Concepts:

- NRR (Net Revenue Retention): Indicates the percentage of revenue retained from existing customers over a period, factoring in churn, downgrades, and expansions. A vital metric for understanding customer success impact. Many SaaS companies become zombies because this metric is eradict or on a continual downward slide. It can last decades and is mainly based on the direction of the executive staff leadership in resisting change or moving too slowly in the tech industry.

- ARR (Annual Recurring Revenue): Represents the predictable revenue from customers annually. Growth in ARR is essential for overall company growth. Sales team have to make up the NRR churn on top of their target goal. its the leaky bucket the Sales team forgets

What if your NRR is not 100%?

No SaaS company has 100% retention - if you hear anyone say this be skeptical. How does this hole typically get plugged and what is the math? What is the formula that determines the additional ARR you need for target growth to compensate for the NRR loss? Think about this. Let's say you set an annual growth target. Once you have this, calculate your new client ARR and assign your quotas to your sales team. Unfortunately, you forgot to add back in your NRR loss. Remember, no company ever has 100% retention. Clients churn for many reasons. So you need to add this back in along with other cost metrics. It's like my other article on investing: for every 10% loss, you need to make it up with 11.1% - it's a compounding effect and it gets worse the bigger the loss is. In a SaaS company and related to these metrics its the Leaky bucket that can't be plugged. What you want is an overflowing bucket. See some examples below.

Calculate the ARR required from new sales to achieve a target growth rate with an NRR loss. Use this formula:

[ ARR{new} = ARR{existing} \times (1 + G) - ARR_{existing} \times NRR ] where:

- (G) = Target growth rate (e.g., 20%)

- (NRR) = Net Revenue Retention rate

- (ARR_{existing}) = Current ARR from existing customers

- (ARR_{new}) = Required ARR from new sales

Examples:

These are straight-line scenarios where the pricing model and client contracts are the same across all clients. These scenario numbers could change based on what type of pricing model you deploy and what tier in the model the client was when they churned. If you churn your upper revenue tiers, the new ARR number might be larger; however, if you churn the lower tiers, the new ARR might be lower. You can adjust to account for the loss and the growth targets. The scenarios are more of an average to illustrate the issue.

Scenario 1:

- NRR: 85%

- Target Growth Rate: 20%

- Current ARR from Existing Customers: $100 million

- Required ARR from New Sales: $35 million

- Percentage Increase in ARR Required from New Sales: 35%

- Target Revenue: $120 million

- NRR Revenue Lost: $15 million

Scenario 2:

- Current ARR: $185 million

- NRR: 89%

- Target Growth Rate: 20%

- Required ARR from New Sales: $57.35 million

- Percentage Increase in ARR Required from New Sales: 31%

- Target Revenue: $222 million

- NRR Revenue Lost: $20.35 million

ARR/NRR Summary Table:

|

Metric |

Example 1 |

Example 2 |

|

Current ARR ($M) |

$100m |

$185m |

|

NRR (%) |

85% |

89% |

|

Target Growth Rate (%) |

20% |

20% |

|

Required ARR from New Sales ($M) |

$35m |

$57.35m |

|

Percentage Increase Needed (%) |

35% |

31% |

|

Target Revenue ($M) |

$120m |

$222 |

|

NRR Revenue Lost ($M) |

$15m |

$20.35 |

Questions you should ask yourself after the company meeting

- Is your company doing the 20% growth rate they stated in the company meetings?

- Is your revenue target calculated based on the formula above, or is it dramatically lower - are they being transparent or is the powerpoint the same every qtr?

If you see these issues, it might be time to evaluate whether the company is on track or truthfully aligned across all departments and people. Are they truthful to their employees?

Here is what happens in many SaaS-based companies that are not aligned or not truthfully communicating with their staff. Eventually, their ARR flattens out, and their products fail to evolve and stay modern. Their sales teams can't keep up with the NRR attrition across the client base. Eventually, the ARR line starts to deteriorate - albeit it starts slowly, and it doesn’t seem to be a big problem. The CS team doesn't make their bonuses every quarter, and the CCO has no way to stop the bleeding - it's a fail/fail. Everyone has heard the term "Drinking the Kool-aid" - this is a good culture unless its tainted with cynaide. Morale and culture is happy on the surface but its a festering wound underneath.

The company can't keep the CS team stable - they churn as fast as the client base - is this happening in your company? Once in a while the ARR line looks static - it might even show signs of recovery occasionally because a small feature was released, a marketing positioning message was updated, and a few big sales landed. One QTR might be good, but 3 QTRs show a decline. The CS team gets a small bonus, but they are always scrambling to fix the attrition to no avail. The product is just not meeting the problems of the client or its not keeping up with modern approaches and the competition is eating away at them or there is just too much competition like what is happening in the CDP bandwagon SaaS niche.

What then happens is, the company can manage to show a 20% return by RIF'ing staff, changing pricing models, cutting operational costs, and rejiggering many facets of the business, but overall, the business is slowly dying. The cycle can repeat itself over a decade or more. They keep telling the staff they are going public soon, but that "Soon" never comes. You hear about modernity but it never comes - its always the next cycle on the product roadmap - you will see the same PowerPoint slides in company meetings, and the same story is told. This happens with 100s of SaaS companies across the globe on an annual basis. I see it repeatedly, read about it, and talk to others working in the industry about it. It is not UNIQUE to any of them. Sales and CS can't overcome the NRR attrition, and the product investment is too low or slow to keep up with the competitive landscape.

What should happen is they should seek a different exit or change the mission and vision of the company to become a private legacy SaaS company. There are many examples. SAS, EPIC Systems, DataBricks, Stripe, and many others. Companies like Adobe, Salesforce, Snowflake, and Databricks tend to acquire these smaller SaaS companies before they turn into another type of zombie. The bigger SaaS company goal is to not turn into zombies themselves but to keep modern and innovative. They had a few benefits and got lucky of course. What they are doing is keeping their ARR line growing by buying up the cashflow revenue and customers from these smaller SaaS competitors. Then they fix the issues these smaller companies were having with the leaky bucket - they let the smaller comapnies innovate for them. The SaaS zombies that get left behind are doomed to stay where they are indefinitely or evaporate unless they can change their vision to a private company vision to create a legacy like SAS or EPIC noted above but they have to be aligned and dedicated to change and transform their business.

A SaaS zombie company is a company that can't raise capital at higher valuation levels but can survive by focusing on productivity and consolidation and praying for innovation.

Zombie companies lack surplus money to invest to promote growth. This is because they barely manage to cover overhead costs such as wages, rent, and interest on loans.

To return to health, zombie companies must reduce their outgoings or increase their earnings. Often, this leads to firings, product price changes, and all sorts of operational cost-cutting. It often never turns out well.

If you are one of these smaller companies and have experienced explosive growth in a few cycles, should you seek an exit? Be humble and not afraid of selling. Don't become another Zombie SaaS company. If you are opposed to getting acquired by the bigger startup unicorns or established behemoths, maybe you will stabilize and keep going - the odds are against you. Still, you probably will not grow much if you do not invest in product innovations and modernity continually — with the new AI advancements, your zombie mode may occur more quickly. Your sales teams cannot plug the leaky NRR bucket with ARR – its not realistic.

Going public is also fraught with even bigger growth issues. While you might benefit from this approach initially, your clients, employees, and several investors will be victims of this approach. It will not cure the NRR churn or culture in the short or long term, and the company will fall back into the same rut as noted above, with the added difficulty of the street scrutinizing the stock and revenue growth every month. You will be raked over the coals day in and day out and it will exhaust the best of your employees. While the going public approach will result in a few getting extremely wealthy and landing them an accolade on their resume - it will not bring a legacy for everyone else to enjoy, and eventually bring you back to zombification. There are many of these on the public boards now and many disappear quickly form the limelight they thought they could enjoy indefinitly.

How to Use This Information:

Executives and newbies can leverage the formula and the insights from these examples in several ways:

- Strategic Planning: Set realistic growth targets based on current NRR rates and historical sales performance. Strategic planning goes beyond ARR/NRR goals and is the primary key to all of this nonsense. It is severely neglected in nearly all SaaS companies and results in misalignment, eroding culture, poorly communicated vision and mission. Most Executive leadership teams do not even know how to approach this task and should seek coaches to help them to help train them. Ego and narcissism are often the culprit that diminish this task.

- Sales Targets: Align ARR sales efforts not just to cover revenue lost from NRR churn but also to contribute significantly to growth. This might mean investing more in your technical sales support teams like SC(Solution consultants) and SA(Solutions Architects) teams to drive Solution vision.

- Customer Success Focus: Highlight the importance of customer success efforts in improving NRR to reduce the pressure on acquiring new sales.Same as with sales - you may have to invest more heavily in enablement tools, content, and SA(Solution Architects), Accont management, Monetizing packaged services and workshops to help your clients.

- Leverage the tools from "Winning by Design (https://winningbydesign.com/resources/blueprints/).

- Alignment, Transparency, and Communication across the company may be your biggest asset as long as you can overcome ego and embrace humility.

Member discussion